On Kleptocracy

Professor Jason Sharman explains why a crackdown on politicians stealing their nations’ wealth could be revolutionary

I have spent the past 10 years investigating kleptocracy. The word means literally, rule by thieves, and describes the specific corruption that occurs when state leaders, generally from poorer countries, routinely loot millions or even billions of dollars from their national treasuries. All too often, the money is spent or stashed in rich countries. And until very recently, rich countries had no moral or legal obligation to do anything about these flows of dirty money.

What does kleptocracy look like? Imagine a nation rich in natural resources. Multinationals vye with each other for government contracts to exploit these resources and, as the years go by, money – large sums of money – begins to pour into the state coffers. Per capita GDP goes through the roof. Yet mysteriously, the population continues to live in poverty. State services remain non-existent. Medicine is scarce. Malnutrition becomes commonplace.

Are you wondering where that imaginary country’s money has got to? Finding the answer is simple. Shift your attention to the world’s financial capitals – London, New York, Geneva and their associated playgrounds – and search for the family name of its leader and the answer is clear. You read in a national newspaper that the country’s leader is buying a $40m mansion in London (purchased alongside a $30m beach house in the south of France and a $50m estate in the Hamptons). The Instagram feed of the leader’s daughter features exotic holidays, designer handbags and private jets. In New York, a bidder ‘known to be close to’ the leader is revealed to have spent more than $50m on fine art and memorabilia at auction.

‘Following the money’ demonstrates theft on a frankly unimaginable scale

But now, for the first time in history, there is a public consensus that for a state to host money stolen by an official of another state is morally wrong. Furthermore, an elaborate system of conventions, treaties, laws and regulations have institutionalised this principle. Of course, many more corrupt leaders get away with their crimes than face justice. But nonetheless, the expectation that host countries have a duty to take action to block or seize their illicit funds is a new and, in many ways, really remarkable development. Rather than lecture poor foreign governments about the error of their ways, rich countries are inviting scrutiny from international organisations and peer countries of their own performance in the sensitive areas of money laundering and corruption.

Deep, structural change

This runs contrary to the doctrine of sovereign immunity (whereby individual state leaders cannot be prosecuted by third countries for acts committed in office). It runs against conventional ideas of national interest (as one interviewee put it to me: “Belgian cops are paid with Belgian taxes to solve Belgian problems” – not crimes committed by political leaders abroad). And it runs counter to the interests of perhaps the most powerful business lobby of all: the finance sector. So why has kleptocracy come into focus?

It is tempting to explain large-scale international moral and legal transformations by focusing on small, dedicated groups of pioneering activists. These activists are said to both prick the conscience of policy makers and provide a blueprint for reform. And it is certainly true that campaigning NGOs such as Transparency International and Global Witness have played an important role.

Of course, many more corrupt leaders get away with their crimes than face justice

But I believe that deep, structural change has been key. The fall of the Soviet Union removed the need to support corrupt anti-Communist client governments, and agreement among development experts and policymakers that corruption causes poverty provided an essential backdrop.

So, while individual scandals revealing the presence of dirty foreign money have created media and political pressure on host governments to take action, it is the background conditions that help to explain why the campaign against kleptocracy resulted in action.

Fighting kleptocracy through asset recovery is said to be worthwhile for three main reasons: it provides new money for development in poor countries; it deters would-be corrupt officials and associated money launderers; and it satisfies the desire for accountability among those in victim countries.

After all the evidence is considered, how well do these claims stack up? First, the money. If something around $5bn of looted wealth has been repatriated, this might seem to be a substantial benefit (even if it represents only a small fraction of the total stolen). Unfortunately, however, this headline figure does not take into account legal fees, investigative expenses or the fact that repatriated assets are often stolen again after they have been returned to the victim government. In practice, the real financial rewards of asset recovery are meagre.

Has the anti-kleptocracy regime dissuaded senior political officials from stealing public wealth and laundering it outside their own country? The evidence does not permit an answer, but with the low chance of being caught, it might be a leap of faith to assume it has. It is possible that certain financial centres may have deterred corrupt officials from placing their money there, though even here the evidence is scarce. Indeed, the mobility of capital could mean a displacement of corruption-related money laundering to a less scrupulous centre (Dubai and Latvia being regularly mentioned as such havens among interviewees), rather than a reduction.

The final payoff is said to be political: demonstrating to victim populations that, sometimes at least, there is justice, and corrupt and tyrannical leaders can be held to account. When corrupt officials are still in power, or efforts to hold them accountable at home have failed, attacking their wealth in host countries may be the only recourse left. Here, the campaign against kleptocracy looks to be on firmer ground. But I would argue that important symbolic verdicts of condemnation and shaming might be achieved more effectively and far more cheaply.

Dismissed as a “hopeless challenge brought by a group of tree-hugging hippies”, the case was won

If the effectiveness of the current anti-kleptocracy regime is low, if the rules fail more often than they succeed, and if the costs too often outweigh the benefits, what, if anything, can be done? I believe there are measures that can improve the status quo. Though jointly radical, each of these suggestions is based on policies that in some form are already in place. These measures are relatively cheap and would improve the effectiveness of the fight against grand corruption. The goal is not so much to boost narrow measures like the number of convictions, or the amounts of money confiscated and repatriated. Instead, it is to advance the broader policy goals of making it harder for kleptocrats to launder the proceeds of their corruption in major financial centres and to promote accountability where there otherwise would be none.

Improving outcomes

Preventive measures are far more cost-effective than remedial action to find, seize and return plundered wealth. So, I would begin with better enforcement: actually checking that firms are following the laws and regulations they should be and applying substantial penalties to those that aren’t. It might be thought that this point is too obvious to mention, but my research found that regulators often do not check on compliance or do so by simply asking firms whether they are complying.

Even when regulators check performance independently, outside the United States they almost never apply meaningful sanctions for those violating the rules.

Where foreign corruption proceeds are found, typically after a regime has fallen, authorities should conduct a full inquiry to find out how illicit funds entered the financial system, and punish those private parties at fault

Second, I believe that traditional domestic tax powers and new international tax agreements have great potential for tracing and seizing illicit funds.

For example, if a kleptocrat has a foreign bank account, it probably earns interest, and failure to report this interest may constitute tax evasion. Tax laws also commonly require that foreign bank accounts, assets and income are declared in the home country – a requirement that corrupt officials seldom meet. And because tax evasion is increasingly a predicate crime for money laundering, these laws may be brought into play as well. Tax authorities can often confiscate assets without having to go to court through raising tax assessments directly against individuals and companies, and, unlike the case for police forces, financial investigation and confiscating wealth from tight-fisted owners are tax agencies’ core functions.

Third are a number of interrelated direct state approaches. These include visa denials, blacklisting and targeted financial sanctions. Denying entry to senior foreign officials on the grounds of suspected corruption was pioneered in the United States by presidential decree before being legislated in 2008. Since that time, the G8 and the G20 have endorsed visa denials for officials suspected of corruption. Although not technically ‘following the money’, visa bans are important in cramping kleptocrats’ proclivity for conspicuous consumption in rich countries. Such bans isolate these officials from their real estate abroad. Visa denials are cheap and legally easy to enforce, so it is eminently practical to use them more often.

Many regimes have been brought down by corruption, and even autocracies like China and Russia fear popular discontent

From drawing up a list of those barred from entering a country, it is only a short step to a more comprehensive blacklist of suspected kleptocrats, or even whole governments. These lists would be public and could augment the visa ban by blocking access to a country’s financial system. There are many state precedents (governments have long used economic sanctions as an instrument of statecraft) but – and this is my fourth proposal, aimed at non-state actors – it may even be possible to have an effective global kleptocracy blacklist of states without any government involvement at all. Transparency International’s Corruption Perceptions Index has achieved wide acceptance as a credible and authoritative measure of corruption (rightly or wrongly) among a wide range of intergovernmental organisations, governments and private actors. Banks already use this index when assessing client risk. Considering the demand for risk-rating information, a kleptocracy blacklist created by a respected NGO could enjoy wide currency and impact among crucial private sector intermediaries.

A more innovative strategy would be for NGOs to take direct action to attack kleptocrats’ wealth. A variety of French groups have publicised the plundered wealth Francophone African leaders have placed in France, but then successfully used the court system to challenge the French government’s inaction and bring criminal charges themselves.

Common-law systems are somewhat less hospitable for these kinds of actions, but even here there are precedents. After the UK government dropped a bribery investigation into British Aerospace Systems in late 2006, the NGOs The Corner House and the Campaign Against Arms Trade took court action to force the government to reopen the investigation. Dismissed as a “hopeless challenge brought by a group of tree-hugging hippies”, the case was won by the two groups in 2008, though it was later overturned on appeal.

Revolutionary possibilities

If the cause of fighting grand corruption came on to the agenda thanks to a confluence of unanticipated events and trends, its future is correspondingly hard to predict. Yet in a world where kleptocracy is unremarkable, holding individual leaders accountable for corruption crimes committed in office is a revolutionary idea that undermines centuries of accepted practice and conventional wisdom.

It has the potential to transform international diplomacy and world politics more broadly. People across every continent are less and less likely to see elite corruption as either acceptable or inevitable. Many regimes have been brought down by corruption, and even powerful autocracies such as China and Russia fear the depth of popular discontent with a ruling class intent on feathering its own nest. So, watch this space. The combination of global rules legislated ‘from above’ with a powerful upsurge of demands for accountability ‘from below’ could mean that, over the long term, the anti-kleptocracy regime may have greater significance than either its most enthusiastic supporters or most critical detractors currently anticipate.

This feature is an extract from The Despot’s Guide to Wealth Management: On the International Campaign against Grand Corruption, by Jason Sharman, Sir Patrick Sheehy Professor of International Relations. Used with kind permission of the publisher, Cornell University Press. All rights reserved.

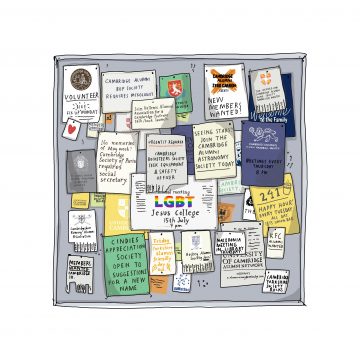

These images, taken by journalist William Clowes, show the abandoned palace compound of Mobutu Sese Seko, who ruled Zaire (now the Democratic Republic of the Congo) between 1965 and 1997.